Articles

Why due diligence is necessary – A property valuer's guide

Purchasing a house will be the most important financial decision most Australians make. To avoid the risks and make a wise investment, you need to be well informed.

Property experts often highlight the need to do your due diligence, but what does that mean? Tim Stafford, Head of Research at WBP Group, reveals the critical information property valuers collect for their due diligence and shows you the best place to find it.

Imagine two houses, identical in size, for sale on the same street. The house at the north end is zoned to a school with an excellent reputation, is a five-minute walk to the local shopping strip, and sits on a rectangular allotment with a wide frontage.

The house at the south end of the street is zoned to a different school with a poorer reputation, sits on a narrower allotment that's susceptible to flooding and has high voltage transmission lines nearby.

You're unlikely to uncover some of these negative features without thorough due diligence. And given these two houses are identical in size and are on the same street, your lack of due diligence may lead you to conclude that they should have a similar value.

With all the relevant information in hand, you realise the value of the first house should be significantly higher, especially if this hypothetical street is in a prestigious suburb.

And if you were aware of just how unappealing the second house was, would you have gone to the trouble of making an offer?

Due diligence is often challenging, even for property valuers, as the relevant information is scattered across countless websites and databases. Fortunately, a new website has transformed the way valuers at WBP Group go about this task.

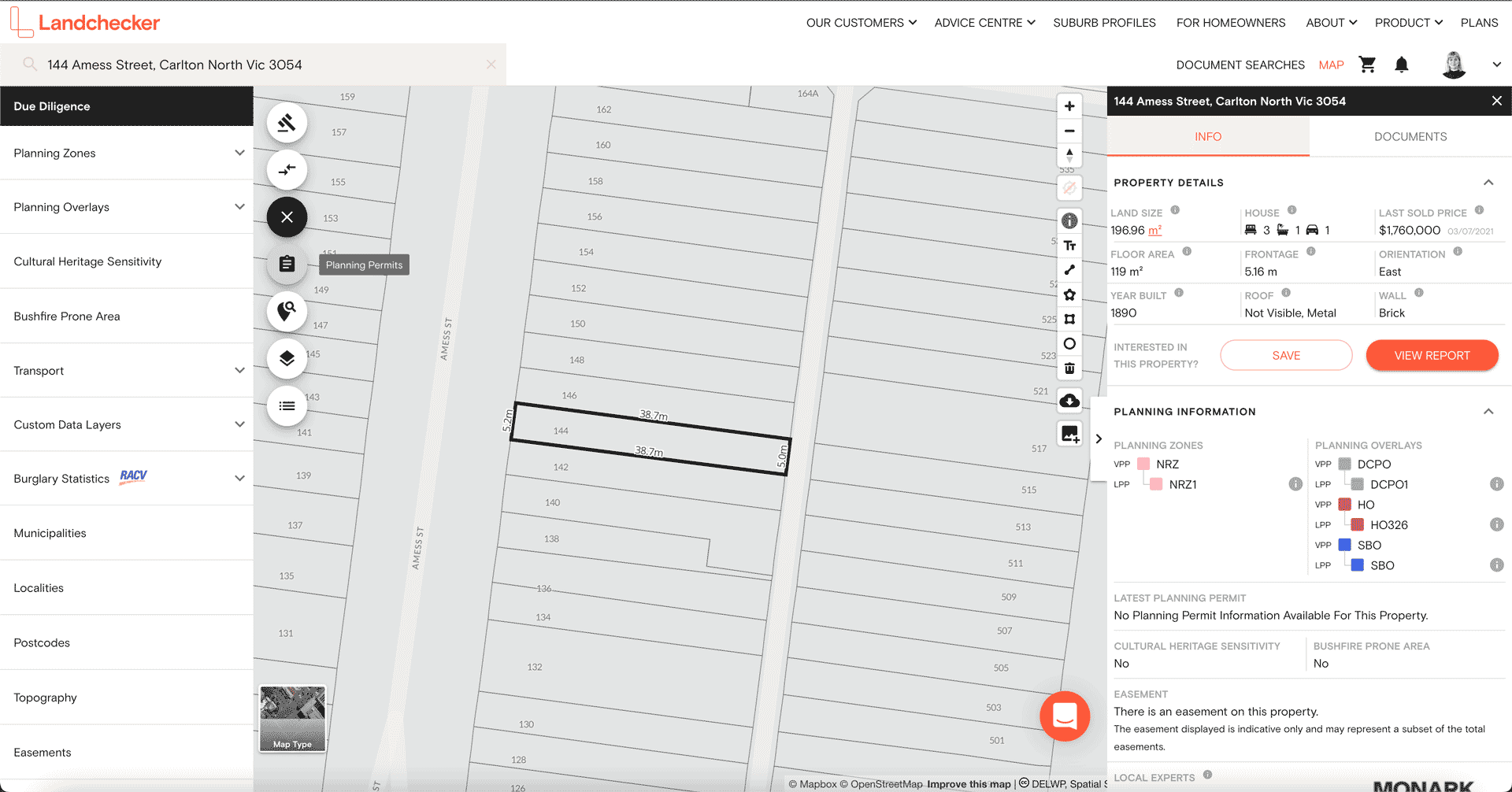

Landchecker, a website first released in 2015, has sought to simplify the due diligence process by providing property data in one place. With their powerful analytics tools, you'll have all the critical information you need right at your fingertips.

While Landchecker's Free Plan includes plenty of valuable property data, you'll need their Professional Plan if you want to go through a thorough due diligence process. While there is a monthly fee for this plan, imagine the time you'll save when you have convenient access to the most relevant information. Also, consider the potential financial risk and emotional heartache you'll avoid by being well informed.

If you're interested in learning more about Landchecker's capabilities, check out their demonstration video.

The critical information you'll need to make an informed decision

As well as inspecting the property and reviewing the vendor statement, what other information should you collect as part of the due diligence process?

1. Location

Everyone has heard the famous slogan, "location, location, location", but why do real estate agents keep repeating it? It's because the location has a significant influence on a property's value.

Factors to consider when analysing the location of your potential new house include;

Public transport: With Australia's major cities becoming more densely populated, convenient access to public transport is critical.

Arterial roads: Cars are still Australia's number one mode of transport, and as a result, our streets are utterly congested. To avoid this pain, you need access to high-capacity arterial roads.

Amenities: These include supermarkets, cafes, parks, and gyms. A location within walking distance of a variety of amenities is ideal.

Schools: Proximity to well-regarded schools is essential for any buyer who has kids or plans to have them.

Using Landchecker's Distance To tool, you'll be able to quickly assess the walkability and driveability of your potential new house.

2. Land size

Size matters! For most properties, a significant portion of their 'value' resides in their underlying land value. So, the bigger the allotment, the more expensive the house.

Frontage is also an essential consideration, especially when building a new house or completing a renovation. The wider your frontage, the more options you'll have when you go through the design process.

3. Zoning and overlays

Your local council is responsible for how you can develop your land, and they use zones and overlays to set the parameters. The three zoning categories are;

Residential

Commercial

Industrial

You can't erect a factory in a residential zone, and you can't build a house in a commercial zone.

Residential zoning typically has several sub-zones. The purpose of these sub-zones is to either encourage or restrict development. In Victoria, councils apply a Residential Growth Zone in areas they want to promote development. To limit development and maintain single residences, they adopt a Neighbourhood Residential Zone.

Similarly, in NSW, councils apply a Residential 1 Zone to areas where they want to encourage low density single and two storey dwellings. They use a Residential 4 Zone when they wish to promote walk-up unit developments or high-rise apartment blocks.

You also need to check the zoning in the area surrounding your potential new house. If your house is close to zoning that encourages development, expect new apartment buildings to start popping up.

Using Landchecker's Planning Permit/DAs tool, you can look at the surrounding area to see what types of developments council have approved. You can also use this tool to check whether your new neighbours are planning on building some kind of monstrosity.

Overlays are an additional tool used by councils to restrict development even further.

Design Overlay – may control the height of any new building you intend to erect

Heritage Overlay – may prohibit demolition and restrict alterations you can make to your house, especially the facade

Flood Overlay – may restrict the size and shape of any new building you intend to erect

Flooding is likely to become much more of an issue as the impacts of climate change increase. It's an overlay to which you should pay particular attention.

4. Past sales history

Knowing the date and price your potential new house previously sold for can be vital when you start negotiations. This information may give you an idea about the seller's price expectations and a clue about their motivation for selling.

5. When was the house built?

When considering the purchase of a house that's over 100 years old, you should do so with the expectation there will be some issues. Whether it's the wiring, the plumbing, or the foundations, you'll likely need to spend some money on rectification works.

While most people are aware of the issues associated with buying something older, they often don't realise that a recently built or modified house can also be problematic.

Builders must follow local and state planning laws and adhere to the Australian building code. However, they don't always do so. Using Landchecker's high-resolution aerial imagery and timeline tool, you can see how the property has changed over time, which can help you identify any modifications. Then, you can check whether the builder obtained the requisite approvals.

Purchasing an illegally built or modified house could cost you thousands of dollars to fix. In the worst-case scenario, you may need to knock it down. If you are unsure whether illegal work has taken place, the building department at your local council is the best place to start.

So, if you're looking at buying a house and you want to go through a thorough due diligence process, Landchecker will help you make an informed decision. They have taken the time to curate the most relevant information and present it in a user-friendly format.

Landchecker is currently available in Victoria, NSW, Queensland, Tasmania and South Australia. Some of their tools are available for Western Australians, with the full suite available soon.

This article is a product review based entirely on the personal opinion and experience of the author. Neither the author nor WBP Group has received any financial benefit.