Partner Articles

The outlook for the Australian development industry is shifting

Samuel Property, Abadeen & Colliers weigh in on the current Development Site market and the pivotal role that proptech platform Landchecker plays in their decision making process.

As we make headway into the final quarter of the 2024 financial year, the outlook for the Australian construction industry is shifting.

With the nation’s construction sector experiencing a boom during COVID, the ongoing challenges posed by the pandemic such as a squeeze in global supply chains and an increase in labour shortages caused by plummeting overseas migration have had a ripple effect on the industry. Widespread negative news reports on “builders going bust” have affected buyer sentiment, with demand dwindling due to strained consumer confidence.

But confidence is rebuilding.

The latest data released by CoreLogic states construction costs rose 0.8% through FY24 Q2. Despite this, this growth remains 20 basis points below pre-COVID decade average of 1%, indicating construction costs continue to normalise, subsequently positively impacting consumer confidence.

Australia’s top developers are seizing this silver lining, shifting gears from neutral and driving into acquisition mode, searching for new sites and sealing deals on prominent parcels to bolster their pipelines.

Ted Dwyer, director of Melbourne metropolitan sales - investment services for property powerhouse Colliers, said enquiry on residential development sites has surged.

"We are experiencing heightened demand for good quality residential development sites right now,”Ted said.

“Typically, we are seeing 100+ enquiries on a campaign, which represents almost double the amount achieved throughout 2022-2023.

The sentiment amongst property developers is continually improving out there."

One such developer is Abadeen: one of the country’s leading property developers with nearly 30 years’ experience. Renowned for delivering exceptional residences in Sydney’s Lower North Shore, Abadeen has only this year expanded into Victoria, solidifying its confidence in a strong market resurgence largely driven by empty-nesters and downsizers.

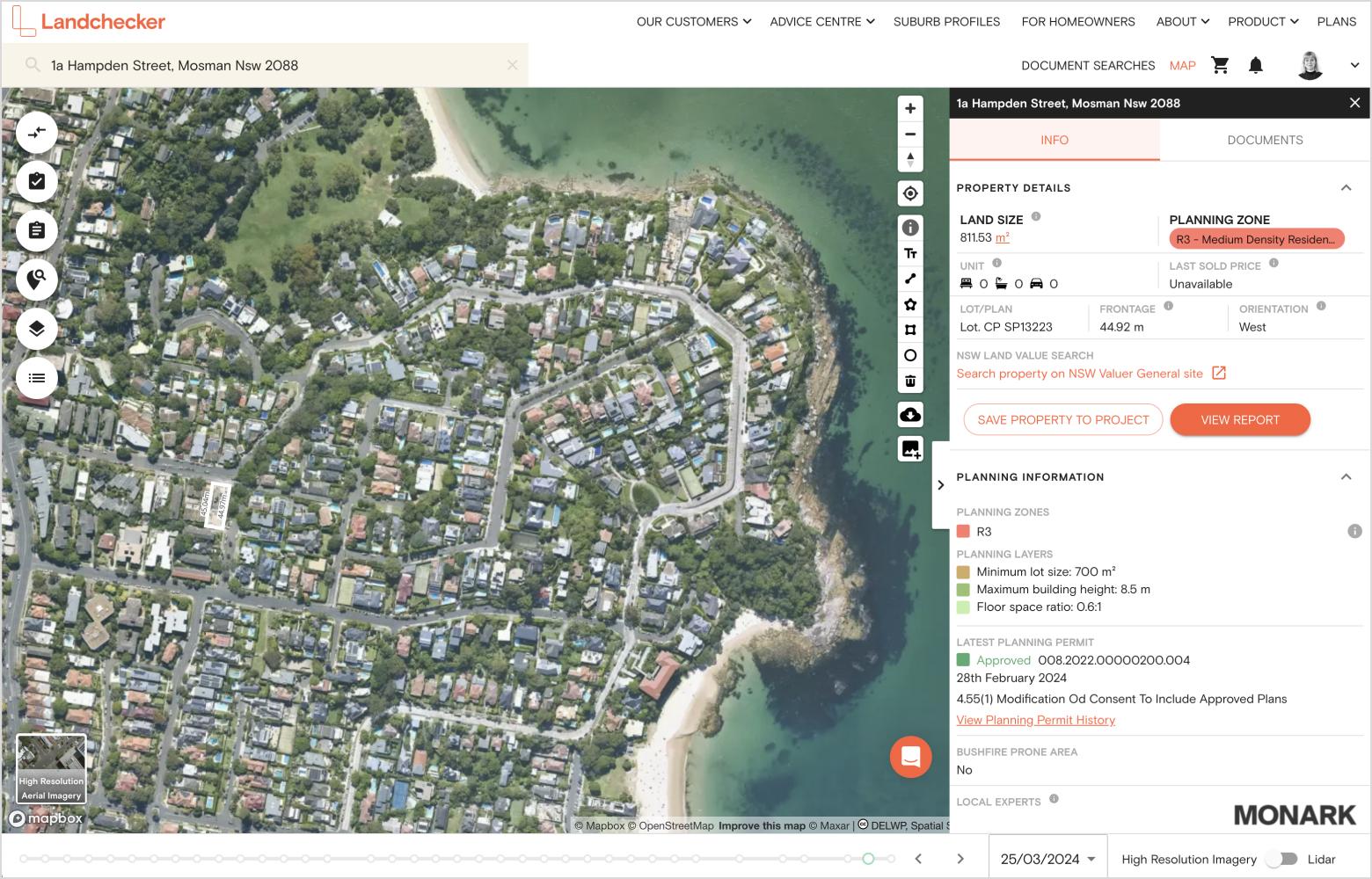

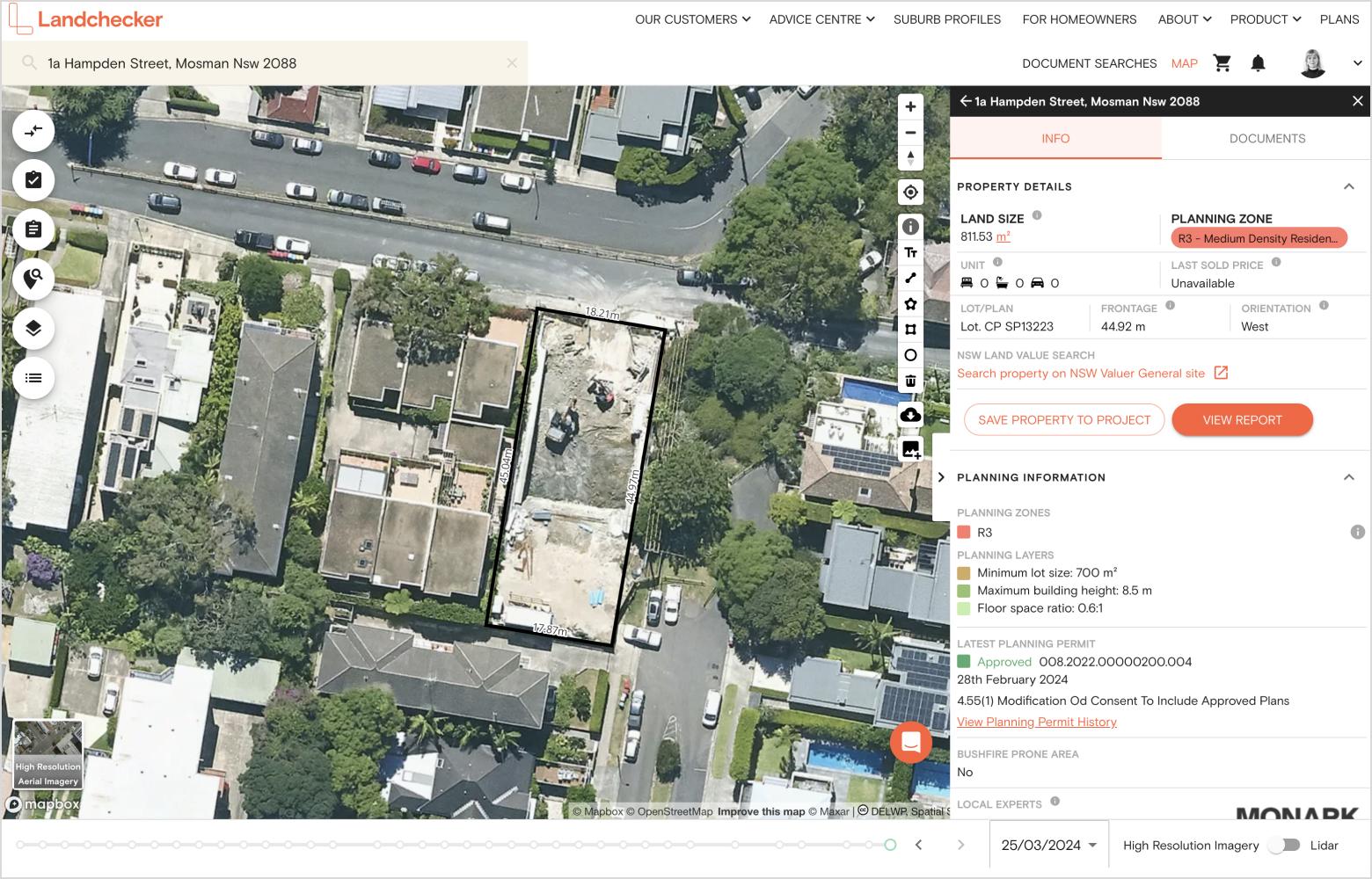

Below: Abadeen’s apartment development, The Hampden Residences in Mosman has commenced construction.

“Abadeen has been active within Sydney’s Lower North Shore for close to 30 years, and we have eight active projects within the area,” said Abadeen head of acquisitions Aaron Arias.

“In New South Wales, our acquisition strategy will remain focused on Sydney’s north and eastern suburbs.

“We’ve also recently launched in Melbourne with two luxury projects in Malvern East and Prahran.

“We believe these high-end markets will continue to garner strong interest from local downsizers and empty nesters who are less affected by market fluctuations,” he said.

Aaron cites strong brand equity and decades of experience as key drivers to a developer’s success in a market that is still correcting from the pandemic.

“In this uncertain environment, Abadeen’s development track record provides us a strong competitive advantage: new entrants into the market won’t have a recognisable brand or the intimate understanding of local markets to compete,” Aaron said.

Above: Abadeen’s apartment development, The Hampden Residences in Mosman has commenced construction.

New legislation in New South Wales proposed by the state government is helping steer Abadeen’s land acquisition strategy. The government’s new planning reform to fast track low and mid-rise residences to help combat the housing crisis and build a better planning system for the future will present an opportunity for developers like Abadeen to unlock sites in the short to medium term. Such an opportunity means competition is high and time is sensitive.

“We are in acquisition mode right now, and anything that saves us time is vital,” said Aaron.

“We have our sights on parcels of land that tick the criteria boxes of the New South Wales government’s State Environmental Planning Policy.

Above: Abadeen’s apartment development, The Hampden Residences in Mosman has commenced construction.

“To help us stay ahead of the competition, we use Landchecker - it delivers us the information we need at our fingertips.

“We create specific lists of properties we wish to target that meet our criteria – like off-market sites in the North Shore within a certain zone – then check the planning details, distance measurements and sales information to build out a basic feasibility then progress from there.

“The decisions Abadeen makes today are crucial to the projects we plan on delivering tomorrow, and Landchecker aids that decision-making.”

Melbourne-based developer Samuel Property is another high-end developer embracing the positive shift in market sentiment and actively seeking opportunities to secure development sites. Specialising in delivering progressive, multi-unit residential projects, Samuel Property’s hallmark is crafting high-calibre homes in neighbourhoods where people want to live – and stay.

Above: Samuel property's "Louise" that overlooks Albert Park Lake has been popular with Buyers.

One such project is Louise - a development comprising 98 apartments in a prime position overlooking Albert Park Lake. Currently under construction and due for completion in 2025, Samuel has seen very strong sales since launching in 2023 with only a few apartments remaining.

“Location is more important now than ever,” said Samuel Property founder and managing director Illan Samuel.

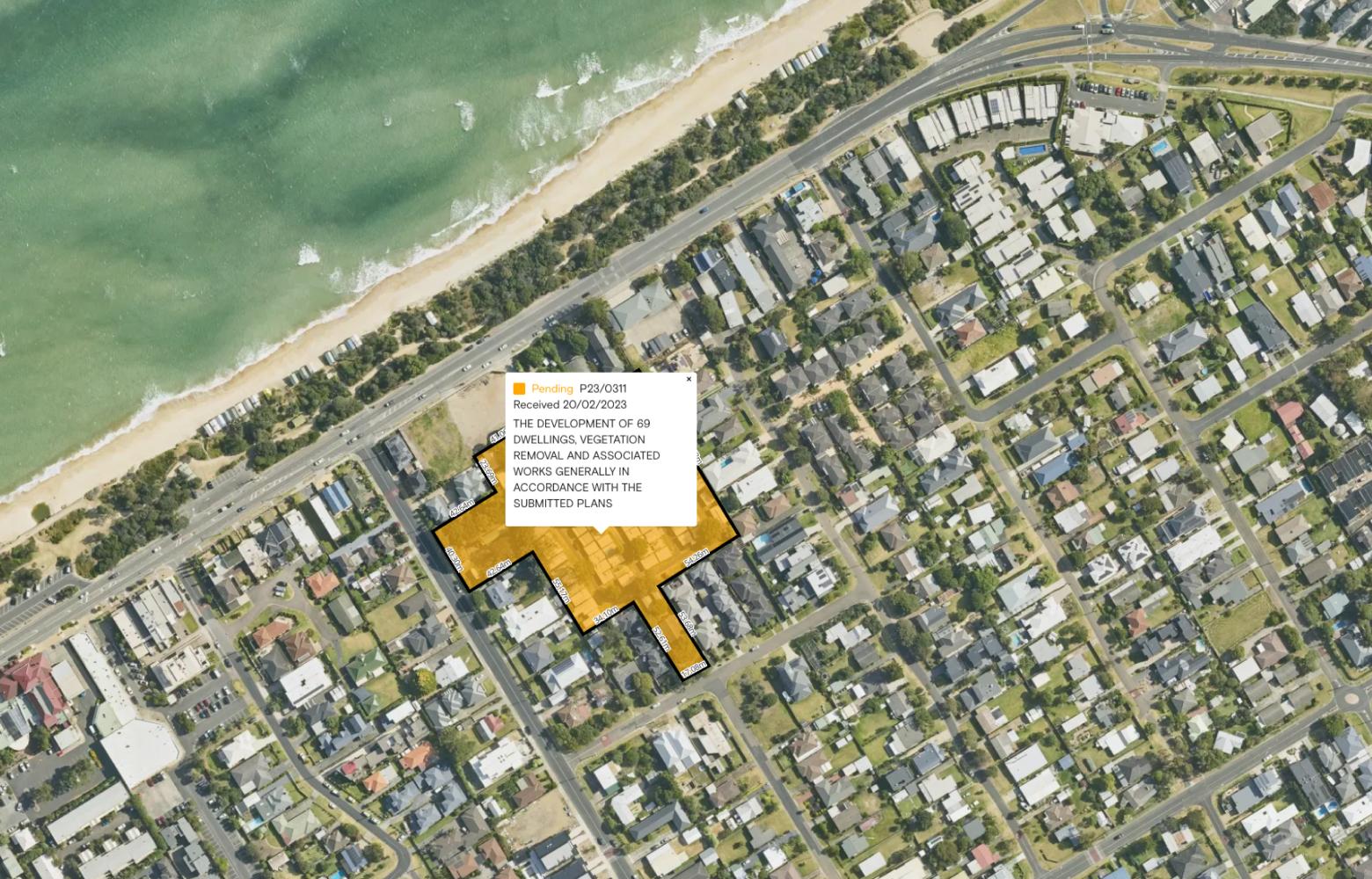

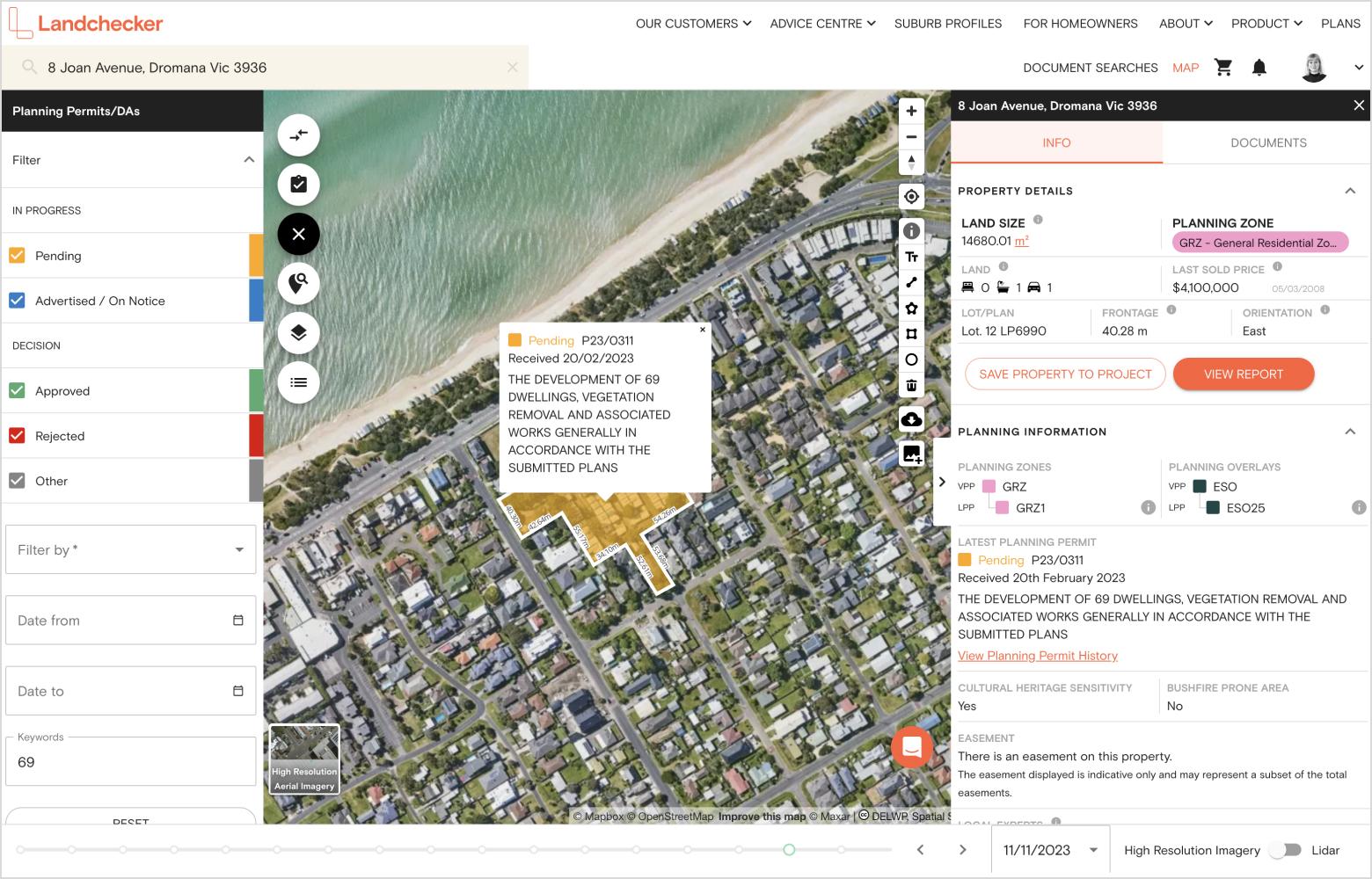

Above: A Landchecker capture of another Samuel project in Dromana. The site consists of 70 townhouses, unlocking much neeeded supply to the Peninsula.

“Samuel’s strategy is to acquire well-located sites zoned for multi-residential development that we know, location-wise, will fill the buyer’s pros list with little to zero cons.

“We then work with meticulous architects and designers to present a standard of excellence in not only the residences we deliver, but also unrivalled amenity that ultimately makes the decision for the buyer an irresistible one.”

Illan believes the positive shift in consumer confidence is due to factors such as stabilising construction costs, the high probability that interest rates will reduce and a general consensus sales values have the potential to increase, improving investment returns.

With demand outstripping supply in the south and eastern corridors of metropolitan Melbourne, Samuel Property is focusing on targeted sites in these lucrative areas as part of its acquisition strategy. But – with each development site it considers potentially being $100m in end value with a three to five year development phase – the Samuel team needs to “love” the sites before even undertaking a feasibility.

Like Abadeen, Landchecker plays a key role in Samuel’s decision-making process.

"Landchecker" is the most efficient way of looking at land quickly with all the relevant information at your fingertips,” Illan said.

“Having the planning zones and overlays, permits and aerial images in one platform makes site selection fast – a breath of fresh air in an industry where speed isn’t the norm, particularly when it comes to long and arduous town planning process.

"Landchecker" has been part of Samuel Property’s acquisition strategy for about five years now.

“It’s an absolute game-changer.”